The clear path to Your Home

Get a personalized mortgage suggestion online in just a few minutes with support in finding the right flat or home. No cost, no pressure.

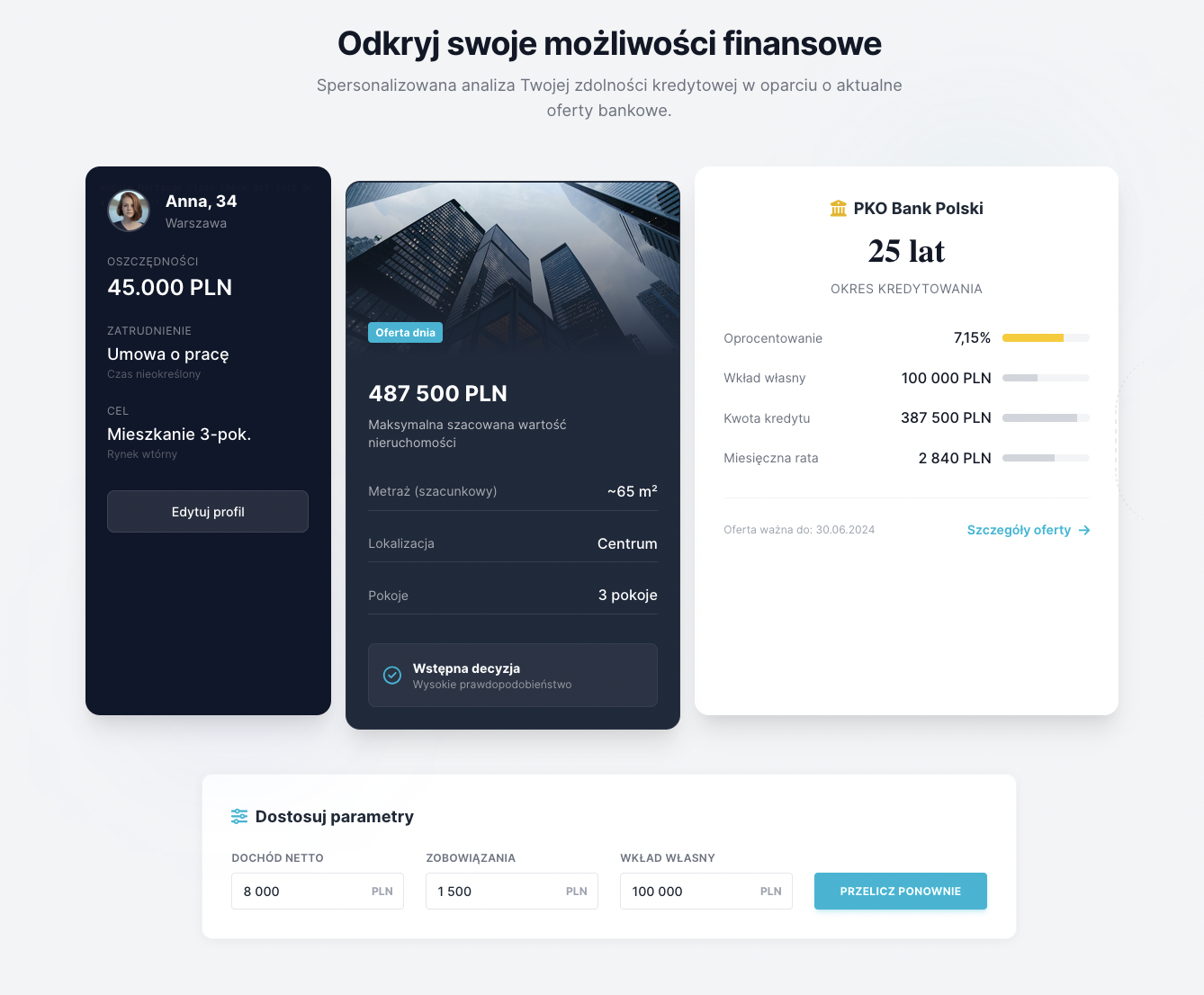

Our meta-search engine finds the optimal mortgage for you

Advanced technology

Our meta-search engine, valuation tools, and consultation technology work together to analyze your needs and compare options efficiently.

Unmatched choice

We help you find the right mortgage for you by accessing offers from over 15 banks.

We compare mortgages

We compare offers from more than 15 banks to find the best deal.

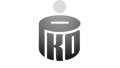

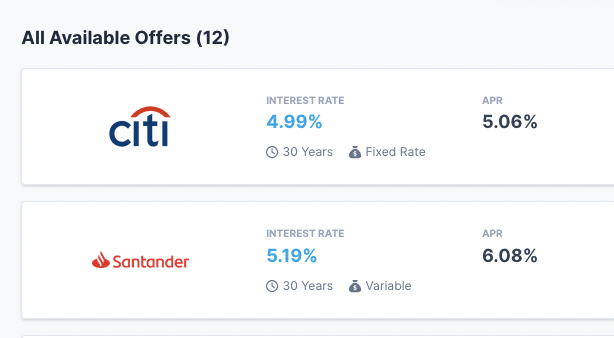

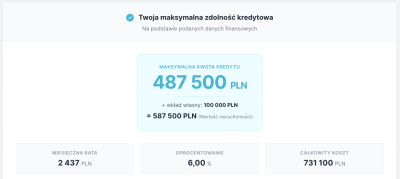

Easily check what you can afford

Just answer a few questions to see what you can afford and where you qualify.

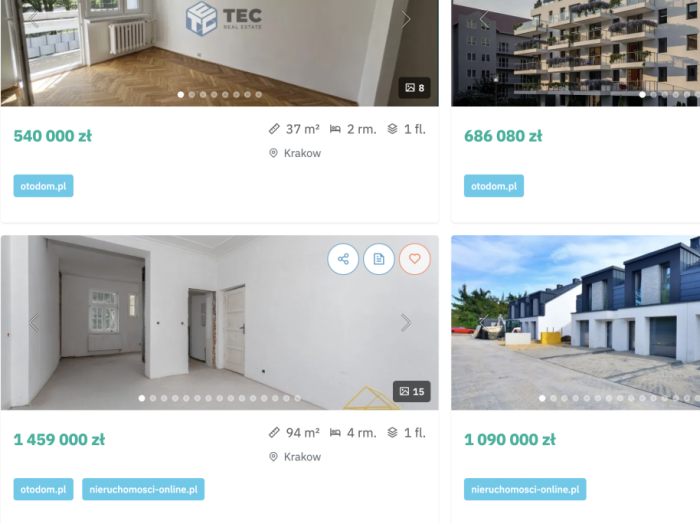

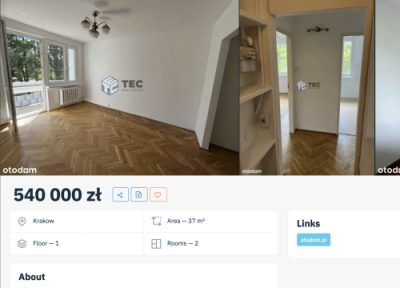

Find all of Polish properties in one place

Our property search engine combines offers from all major platforms and notifies you of new listings based on your search preferences.

Do you still have questions?

We've got answers.

Is the service free?

Yes, our service is always free. Just like any mortgage broker, we get paid a standard commission by the lender for processing a successful mortgage application. This commission will always be paid by the lender and not by you the customer. As a privately owned and independent company we strive to always deliver the best result for our customers without compromising our values.

How does it work?

Start by calculating what you can afford, our platform will then suggest properties you may be interested in. Or simply fill in the details of the property you'd like to finance and we'll calculate your optimal mortgage, advising you on how long to fix the interest rate, how quickly to repay your mortgage and how much equity to invest.

How can I refer RealtyTM to a friend?

We are happy if you are satisfied with us and you want to recommend us to your friends and family. The easiest way to do this is to log in to your account or click here. Then, you can share your personalized referral link either by email or via social media.

How is my data secured?

Your data is encrypted during transmission over a secure connection with our advanced SSL (Internet Security Protocol) certificate. Upon arrival at our data center, we encrypt your data using an AES-256 encryption algorithm. All servers we use are located in EU. Information about our privacy policy can be found in our privacy notice.

Is now a good time to buy property for own use?

If you are considering purchasing a property but are still unsure of whether you should wait and save, there are a number of factors that you should take into account. Having a relatively high rent indicates that the sooner you buy, the more you save. This is especially significant if property prices are rising quickly, under which circumstances it makes sense to buy sooner unless you can save at a higher pace per month.

How will RealtyTM find me the right mortgage product?

We review the mortgage products and conditions available all the time – we scour over 16 lenders and their conditions on a daily basis. We then model and estimate their hidden conditions. This is how we know exactly what is out there and can feed these conditions into the recommendation engine.

16

Banks

100 k+

Properties

99.5 x

Customer Satisfaction

Get a free online mortgage

recommendation in minutes

Yes, its free, online and non-binding!